AI-powered investment platforms are everywhere, promising effortless profits and smart trading. But many are elaborate scams designed to steal your money. Learn how to spot the fakes and protect yourself.

The Rise of Fake AI Investment Platforms

In recent years, the buzz around artificial intelligence has fueled a wave of new investment platforms. Many promise to use advanced algorithms to generate huge returns. Unfortunately, scammers have seized on this trend, creating fake AI platforms that look convincing but are designed to defraud investors.

People fall for these scams because they exploit trust in technology, use slick marketing, and often show fake dashboards with impressive results. The promise of easy money and cutting-edge AI is hard to resist.

Typical Signs of Scam Platforms

Fake Returns & Unrealistic Promises

Scam platforms often guarantee high returns with little or no risk. If it sounds too good to be true, it probably is. For example, John from London invested $5,000 in a platform that promised 20% weekly returns. Within a month, his account showed $10,000—but he couldn’t withdraw a penny.

No License or Regulation

Legitimate investment companies are licensed and regulated. Scammers avoid regulation and may use fake certificates or registration numbers. Always check for real regulatory oversight and search for complaints online.

Unrealistic Testimonials

Fake platforms often display glowing reviews and testimonials that can't be verified. Look for real, independent feedback. If all testimonials sound too perfect, be skeptical.

Common Red Flags

Pressure to Deposit More

Scammers push you to deposit more money, often with time-limited offers or bonuses. They may block withdrawals or invent reasons why you need to "upgrade" your account. For instance, Maria from Berlin was told she needed to deposit another $2,000 to unlock her "AI bot’s full potential"—but her money vanished.

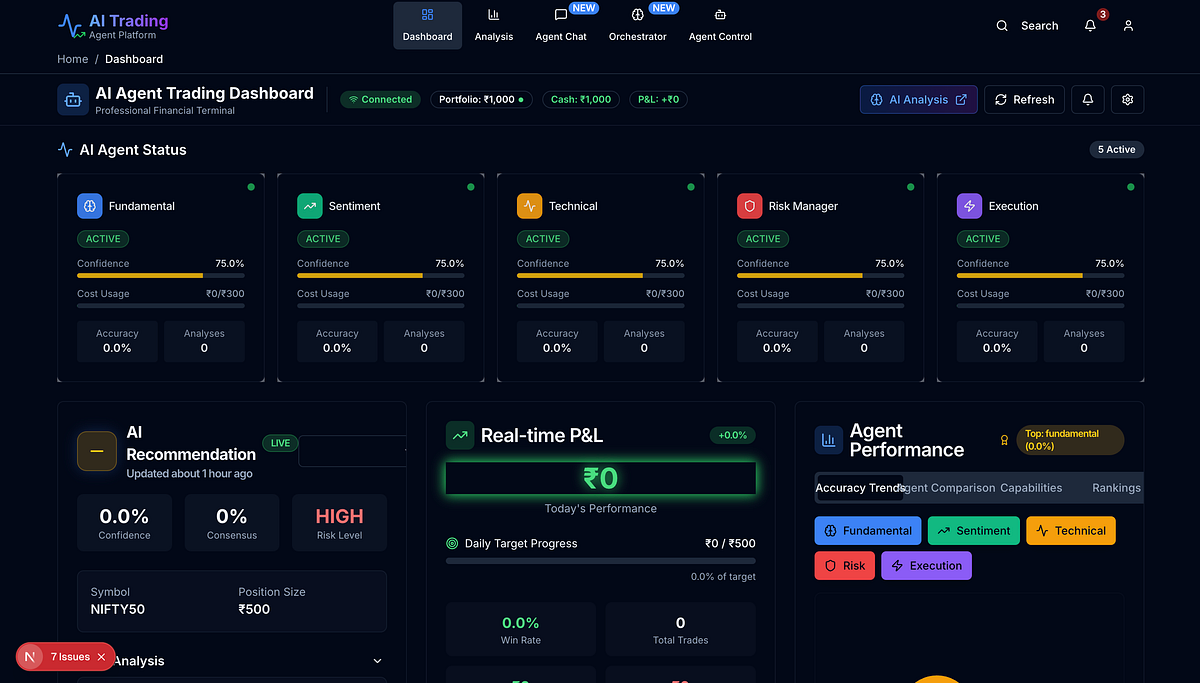

Fake Dashboards & Data

Many scam sites show fake trading dashboards, charts, and balances. These are designed to look real but are just for show. If you can’t verify the trades or withdrawals, it’s a major red flag.

Examples of AI & Crypto Investment Scams

"AI Trading Bot" Scams

Sites claim to use AI bots to trade crypto or stocks, but the bots don't exist. All profits shown are fake. For example, a platform called "QuantumAI" lured hundreds of users with videos of a supposed AI bot, but the bot was just a stock photo and the trades were never real.

Ponzi Schemes Disguised as AI

Some platforms use new deposits to pay "returns" to earlier investors, then disappear when growth slows. If you’re encouraged to recruit others, be wary—it’s likely a Ponzi scheme.

How to Protect Yourself

Verify Company Legitimacy

Check for real licenses, regulatory oversight, and independent reviews. Search for complaints or warnings online. If you can’t find any, proceed with caution.

Never Rush Into Deposits

Take your time. Scammers want you to act fast. If you're pressured, walk away. No legitimate company will rush you into investing.

Ask Questions

Contact the company and ask for proof of regulation, real customer references, and details about their technology. If answers are vague or evasive, it’s a warning sign.

What to Do If You've Been Scammed

If you've already lost money, act quickly. Gather all evidence, report the scam to authorities, and contact recovery experts like RecoverX Alliance. Don’t be ashamed—scams are designed to trick even smart, careful people. The sooner you act, the better your chances of recovery.

Conclusion

Fake AI investment platforms are getting more sophisticated, but you can outsmart them. Stay alert, do your research, and never invest more than you can afford to lose. If you've been scammed, help is available.