Forex trading is a magnet for both opportunity and deception. Modern scammers create slick websites, fake dashboards, and even assign you a “personal manager” to win your trust. If you’re reading this, you’re already ahead of most — awareness is your best defense.

How Scammers Build Trust

Scammers use proven psychological tricks to win your trust. Here’s how it usually works:

- Personal account manager: A “friendly” consultant is always available and responds quickly. This creates a sense of care, but as soon as you try to withdraw money, they disappear.

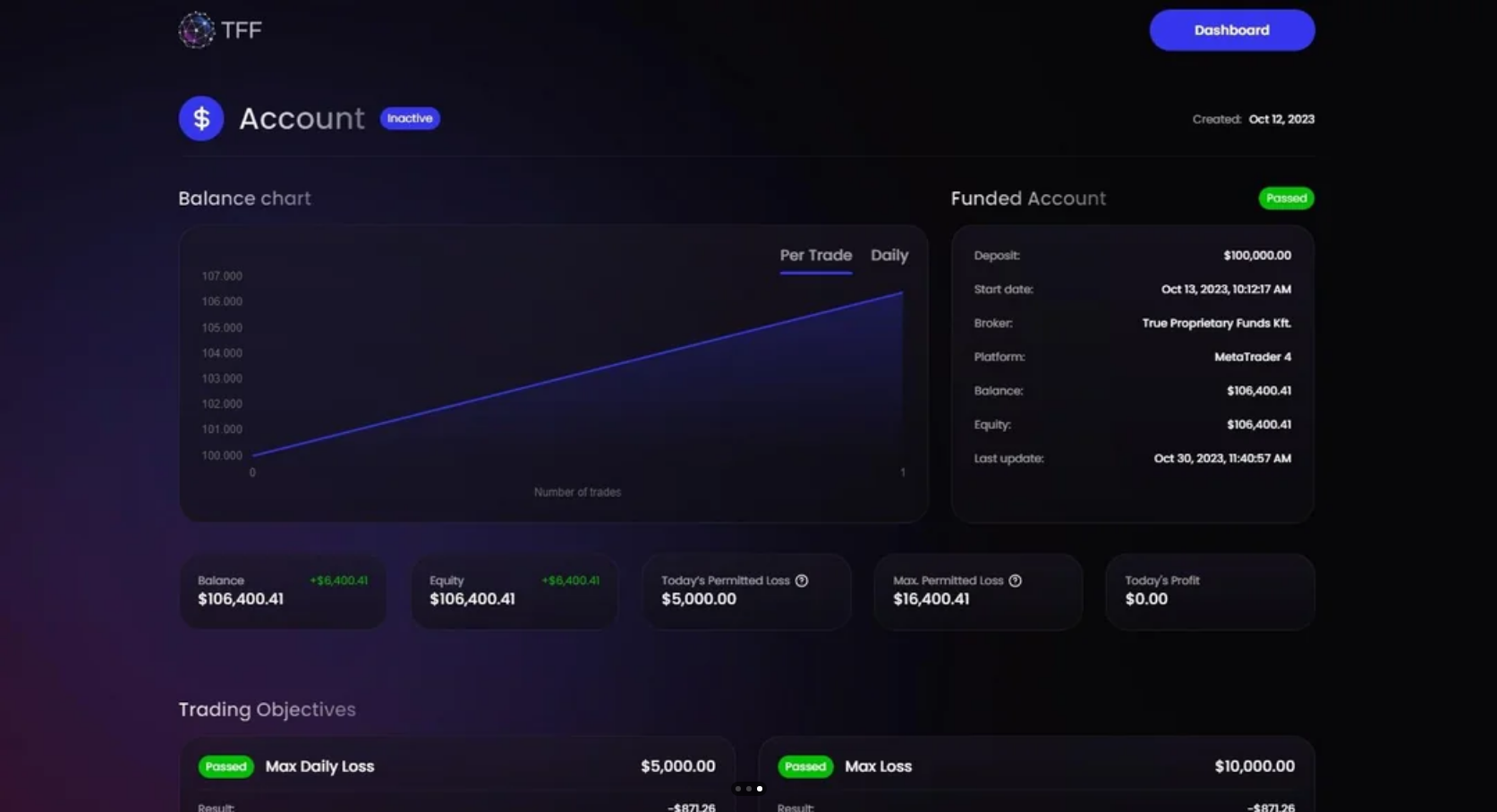

Example: “Your manager is always in touch while you deposit. But when you try to withdraw — they ignore your messages.” - Fake screenshots and success stories: You’re shown fabricated profit reports, charts, and testimonials from other “clients” to convince you the earnings are real.

Example: “Look, here’s a withdrawal screenshot — we’re legit!” - Gradual involvement: At first, you’re allowed to withdraw a small amount to build trust, then the pressure starts: “You’re missing out!” or “This offer ends soon!”

Example: “You’ve already made money, but if you invest more — you’ll get a bonus!”

Most Common Forex Scam Types

Scam tactics may differ, but the goal is always the same — to take your money. Here are the most common types:

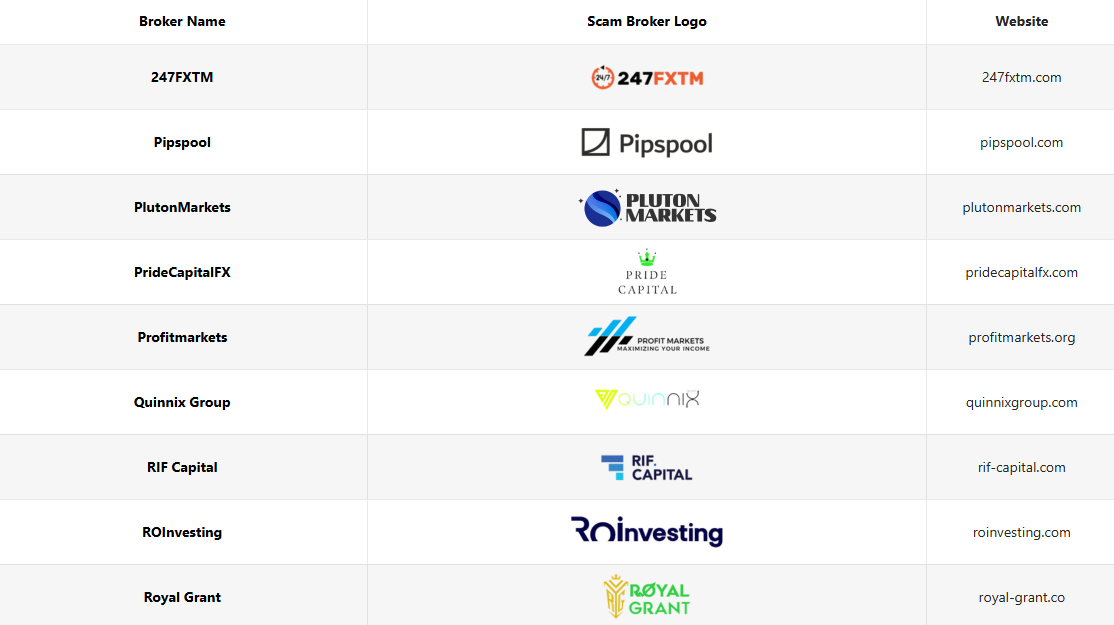

- Cloned brokers: Fake sites copying the design and name of real companies. You can spot them by a strange website address or a fake license number.

Example: The website address differs by one letter or symbol, and the “license” can’t be found on the regulator’s site. - Robot & AI trading: Promises of automatic profits using “artificial intelligence,” but all results are fake.

Example: “Our bot brings 10% per week — just fund your account!” - Managed accounts: You give an “expert” access to your account, and they simply withdraw all the funds.

Example: “Give us access — we’ll earn for you!” - Signal groups: Telegram/WhatsApp channels with paid signals that actually just drain your money.

Example: “Pay for signals — and you’ll get rich!” - Withdrawal fees & taxes: Before withdrawal, you’re asked to pay a “tax” or “fee,” after which the scammers disappear.

Example: “To get your money, pay a 10% tax — only then can you withdraw.”

Red Flags: How to Spot a Scam

Watch for these signs — if you see them, you’re likely dealing with scammers:

- No license: You can’t find the broker’s registration on the regulator’s website (FCA, ASIC, CySEC). Always check the license number on the official site.

Example: The broker refers to a license, but there’s no such company on the regulator’s site. - Strange website address: The address has extra characters, dashes, or letters, or differs from the original domain.

Example: Instead of “broker.com” — “brokerr.com” or “broker-com.com”. - Guaranteed profit: No one can promise risk-free returns — that’s a clear scam.

Example: “100% profit in a month — no risk!” - Upfront fees required: Real brokers don’t ask you to pay for withdrawal or “verification.”

Example: “To withdraw money, pay a 5% fee.” - Pushing crypto: You’re asked to send money to personal wallets or through anonymous services.

Example: “Only USDT transfer, otherwise it won’t work!” - Urgency pressure: “Limited time only!” or “Just today!” — classic manipulation.

Example: “Only until the end of the day — or you’ll lose your chance!”

How to Check a Broker Before You Deposit

Before you fund your account, always check the broker on these points:

- Check the license: Find the license number on the broker’s site and verify it on the regulator’s website. Don’t trust screenshots — only official sources.

Example: The broker lists a number, but there’s no such company on the regulator’s site. - Read reviews: Searching the company name and reviews on independent forums often reveals scams.

Example: A quick search shows complaints about non-payments. - Check the address: Real companies list an office and legal address, which you can find in business registries.

Example: The address doesn’t exist or belongs to another business. - Test withdrawals: Try withdrawing a small amount before depositing large sums.

Example: The broker refuses to process even minimal withdrawals. - Don’t send to personal wallets: Real brokers never ask you to send money to private accounts or through anonymous services.

Example: “To fund your account, use this USDT wallet only.”

If You’ve Been Scammed: What to Do

If you’ve already fallen victim to scammers — act fast! Here’s what to do step by step:

- Stop all contact: Don’t reply to messages, don’t call, and don’t send more money. Save all correspondence and emails — they’ll be needed for investigation.

Example: Scammers may keep trying to convince you to invest more — don’t fall for it! - Gather evidence: Save bank statements, receipts, screenshots of transfers and chats. The more info you have, the better your chances of recovery.

Example: Screenshots of chats, payment receipts, emails from the broker. - Contact your bank or payment provider: Ask to reverse the transfer or open a dispute. Sometimes money can be returned if you act quickly.

Example: The bank may block the transfer if you act fast. - Report to police and regulators: File a report with law enforcement and financial regulators. Provide all details and attach your evidence.

Example: Police report, complaint to the central bank or foreign regulator. - Contact recovery specialists: Professionals can help speed up the process and prepare documents correctly.

Example: Fund recovery companies, legal firms.

Legal & Recovery Options

There are several ways to get your money back — use every option available:

- Chargeback: If you paid by card — contact your bank immediately and explain the situation. The faster you act, the better your chances.

Example: The bank can return the money if you prove fraud. - Bank transfer: Sometimes the bank can reverse the transfer if you file a request quickly.

Example: If the money hasn’t reached the recipient yet, the bank can return it. - Payment systems: If you used PayPal or similar — open a dispute and describe the scam.

Example: PayPal often returns funds if fraud is proven. - Crypto: Harder to recover, but if funds hit an exchange — there’s a chance to trace and freeze them.

Example: Contact the exchange with a fraud report. - Legal claims: For large sums — contact lawyers and file complaints with regulators.

Example: Class actions, complaints to the central bank, appeals to foreign regulators.

Real Story: Anna’s Recovery

Anna from Sydney invested $5,000 in a “guaranteed AI trading” platform. After seeing fake profits, she was blocked from withdrawing and told to pay a $300 “release fee.” Anna quickly gathered her evidence, contacted her bank, and hired recovery experts. Within four weeks, she got back 85% of her funds. Speed and documentation made all the difference.

"I lost $5,000 to a fake AI trading platform. After they blocked my withdrawal and asked for more fees, I saved all my evidence and contacted recovery experts. In 4 weeks, I got back 85% of my funds. Act fast and keep your records!"

Quick Protection Checklist

Check yourself against this checklist — these are simple but effective protection measures:

- Check licenses: Always look up the broker in the regulator’s registry.

Example: The official regulator’s website is your main source of truth. - Two-factor authentication: Use strong passwords and SMS/app login confirmation.

Example: Even if scammers get your password, they can’t log in without the code. - Never send money to personal wallets: This is a major red flag.

Example: The broker asks you to send USDT or Bitcoin — that’s a warning sign. - Test small withdrawals: Before investing large sums, make sure withdrawals work.

Example: If the broker won’t let you withdraw even $10 — don’t risk more. - Keep records of all transactions: Save chats, receipts, and screenshots.

Example: Keep all payment confirmations and support correspondence.

Conclusion: Outsmart the Scammers

Scammers are getting more sophisticated, but you can be smarter. Spot the warning signs, verify every detail, and don’t give in to pressure. If you’ve already lost money — don’t waste time, gather evidence and seek help. Knowledge and speed are your best allies.